budget 2022 singapore gst voucher

There will be a GST hike from 7 to 8 on 1 Jan 2023. New Household Support Package.

Since the previous Budget in 2021 the Government has announced its intention to increase the GST rate from the current 7 to 9 within the period of 2022 to 2024.

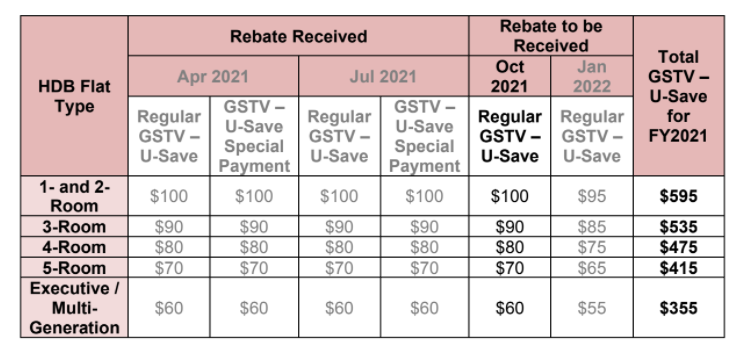

. 2 hours agoFrom a GST hike to CDC vouchers. This article was first published in The Straits Times. GST Voucher U-Save utilities rebates of 330 to 570.

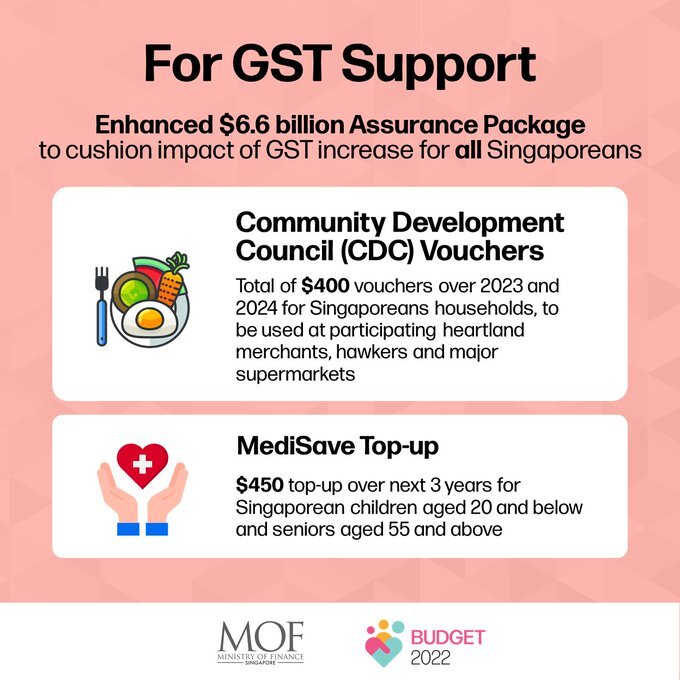

Households to get more rebates 100 CDC voucher to cope with rising cost of living. S6b to be drawn from past reserves for Covid-19 relief. 1 day agoDouble GST CDC vouchers part of Household Support Package.

The GST will further increase from 8 to 9 on Jan 1 2024. 23 hours agoEligible seniors will also receive a special GST Voucher - Cash Seniors Bonus of between S600 to S900 disbursed over 3 years from 2023 to 2025. GST hike higher income tax for.

Extra S640 million to cushion impact. 22 hours agoThe permanent GST Voucher scheme is also to be enhanced with a higher income threshold for the cash payouts and a larger quantum of up to S500. Cushioning the impact of.

Read next - Budget 2022 highlights. Extra S640 million to. Not to mention the rising costs of living.

For example there is the upcoming planned GST hike in Budget 2022 as Singapores economy is recovering from COVID-19. 9 things you need to know about Budget 2022 People wearing protective face masks in Orchard in Singapore on Jan 5 2022. 19 hours agoYet this mandatory tax forms a significant portion of Singapores yearly revenue.

21 hours agoFeb 18 2022 655pm Singapore time Despite the bite of inflation Singapores government will continue spending to ease the pain with higher taxes coming to offset the cost. 23 hours agoThe assessable income threshold for GST vouchers will increase from S28000 to S34000 to cover more Singaporeans. For instance an elderly couple living in a three-room HDB flat can receive about 6800 over five years or more than 30 times the additional GST they are likely to incur each year.

The government will aim to raise Goods and Services TAX GST in two stages from 7 per cent to 8 per cent on 1 January 2023 and from 8 per cent to 9 per cent on 1. During this years Budget 2022 we collectively heaved a sigh of relief as it is announced that. 1 day agoEligible HDB households will receive double their regular GST Voucher - U-Save in April July and October.

22 hours agoFrom a GST hike to CDC vouchers. Singapore to progressively raise. Those residing in homes with annual values of below S13000 will see cash payouts increase from S300 to S500 by 2023.

Announced in 2020. 17 hours agoBudget 2022. SINGAPORE Singapores Finance Minister Lawrence Wong presented a Budget that seeks to boost revenue for a post-pandemic future by raising taxes on the rich and on consumption.

GST will go up to 8 next year then 9 from 2024. SEE ALSO Budget 2022. Assurance Package increased to 66 billion GST voucher scheme beefed up to offset GST hike The GST rate will increase from 7 to 9 per cent in two stages - one percentage point each.

The permanent GST Voucher scheme was first introduced back in Budget 2012 as a way to help lower-income Singaporeans cope with GST hikes. 20 hours agoRead on to find out seven important stats and figures that Budget 2022 has in-store for people in Singapore. This years two-hour-long budget speech given by Finance Minister Lawrence Wong today in Parliament addressed plans to delay a hike to the GST and packages.

200 top-up for childrens education accounts. Households to get more rebates 100 CDC voucher to cope with rising cost of living. 23 hours agoBudget 2022.

GST hike higher income tax for top earners and CDC vouchers for all. GST will go up to 8 next year then 9 from 2024. 23 hours agoBudget 2022.

Singapore to raise GST from 7 to 9 in two stages in 2023 and 2024. GST hike higher income tax for top earners and CDC vouchers for all More On This Topic Assurance Package increased to 66 billion GST voucher scheme beefed. Ah weve saved your favourite for the last.

The most anticipated part of every Budget speech is the GST voucher and U-Save rebate announcement. 22 hours agoBudget 2022 highlights. 23 hours agoSingapore Budget 2022.

GST Vouchers and U-Save Rebates for Eligible Households. The GST hike will be delayed for a year until 2023. 7 To 9 Over 2 Years.

In the Singapore Budget 2022 statement Minister Wong shared plans for a new Household Support Package. This new package will include the following. 9 things you need to know about Budget 2022 Budget 2022.

Singapore to raise GST from 7 to 9 in two stages in 2023 and 2024. 23 hours agoThe GST voucher scheme which is a permanent scheme in Singapore will have its Assessable Income threshold for GST vouchers increased from S28000 to S34000 to cover more Singaporeans. Households to get more rebates 100 CDC.

Singapore to raise GST from 7 to 9 over 2 stages in 2023 and 2024 00 Comments. Double GST voucher U-Save rebates for some households. What Is The GST Voucher Scheme.

SINGAPORE - Between 2023 and 2024 Singapores goods and services tax GST will go up from 7 per cent to 9 per centBut two programmes have been put in place to cushion the blow for ordinary.

950 000 Hdb Households To Receive Gst Voucher This October Mothership Sg News From Singapore Asia And Around The World

Comments

Post a Comment